december child tax credit amount 2021

Ad We Specialize in the IRS. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Child Tax Credit Definition Taxedu Tax Foundation

The letter says 2021 Total Advance Child Tax Credit.

. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18.

Heres an overview of what to know. The credit was made fully refundable. You can get more when you file.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per. December 15 and. To get assistance filing for the Child Tax Credit click here.

Your newborn child is eligible for the the third stimulus of 1400. And unless Congress decides to extend the monthly payments the final installment will come in December. Makes the credit fully refundable.

Advance Payment Process of the Child Tax Credit. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. By making the Child Tax Credit fully refundable low- income households will be.

We dont make judgments or prescribe specific policies. Find COVID-19 Vaccine. Increases the tax credit amount.

Resolve That Confusion By Finding a Tax Service. Call Today for a Free Initial Consultation. Half the total credit amount was paid in advance with the monthly payments last.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per. If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit.

Of the 2021 Child Tax Credit. Child Tax Credit payments continue to be distributed across the United States in a bid to ease the financial burden caused by COVID-19. The Child Tax Credit has been.

If the total is greater than the Child Tax. The first half of the credit is being sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when parents file their income tax returns for 2021. See what makes us different.

In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments. The credit amount was increased for 2021. But you are still able to receive the full amount of the 2021 Child Tax Credit.

Typically the child tax credit provides up to 300 per month for each child under age 6. When you file your 2021 tax return you can claim the other half of the total CTC. December 15 2021.

Max refund is guaranteed and 100 accurate. Your newborn should be eligible for the Child Tax credit of 3600. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The 2021 CTC is different than before in 6 key ways. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. A childs age determines the amount.

For more information regarding how advance Child Tax Credit payments are disbursed see Topic E. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Eligible families from July to December 2021.

Families will get the. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Ad Free means free and IRS e-file is included.

Removes the minimum income requirement. Even if you dont owe taxes you could get the full CTC refund. Have been a US.

The remaining 1800 will be. The 2021 advance was 50 of your child tax credit with the rest on the next years return. Compare 1000s Of Ratings On Tax Companies Online.

The enhanced child tax credit expired at the end of December. You may claim the remaining amount of your 2021 Child Tax. Disbursed on a monthly basis through December 2021.

Learn more about the Advance Child Tax Credit. Parents income matters too. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

This year starting in July. How big will your child tax credit be on your 2021 tax return. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season.

Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit. Unless Congress takes action the 2020 tax credit rules apply in 2022. Of the amount will be paid as part of the 2021 tax return.

Of up to 300child under age 6 250child ages 6 to 17. How Much Were the Child Tax Credit Payments Each Month. Ad Back Taxes Can Be Confusing.

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Childctc The Child Tax Credit The White House

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

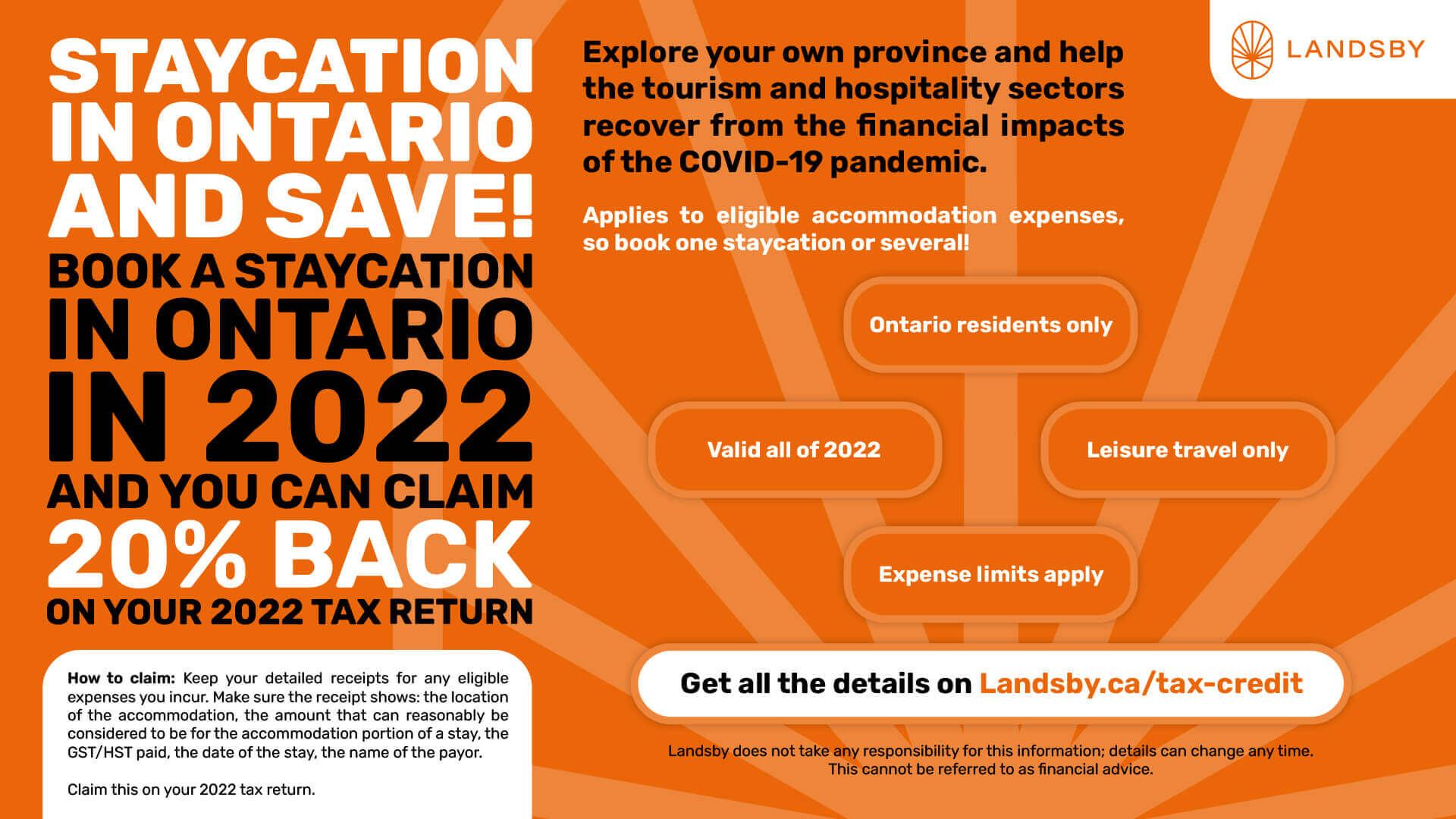

2022 Ontario Staycation Tax Credit Guide Landsby

The Future Of The Child Tax Credit Tax Pro Center Intuit

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Tax Credit Definition How To Claim It

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Missing A Child Tax Credit Payment Here S How To Track It Cnet